Local News

50th Annual Celebration of the Leon County Funtier Days

--

50th Annual Celebration of the Leon County Funtier Days --

The 50th Leon County Funtier Days festivities lit up Leon County last week, drawing thousands of residents and visitors to celebrate Independence Day with parades, competitions, and cherished traditions. Held from July 2nd through July 5th, the events delivered action-packed days of community spirit and fun for all ages.

Centerville FFA Shines at 97th Texas State Convention

From June 30th to July 3rd, Centerville FFA chapter members and advisors made their mark at the 97th annual Texas State Convention in Fort Worth. The event drew approximately 16,000 attendees—FFA members, agriculture educators, and supporters—from across the state.

Maylee Hartnett, Gavin Van Reenen, Cooper Metcalf, Kutter Rodell, Amarius Phillips, Landri

Carter, Abigail Neyland, and Jevin Gonce - Photo Courtesy of Wendy Neyland.Check Your Subcription Date!

--

Check Your Subcription Date! --

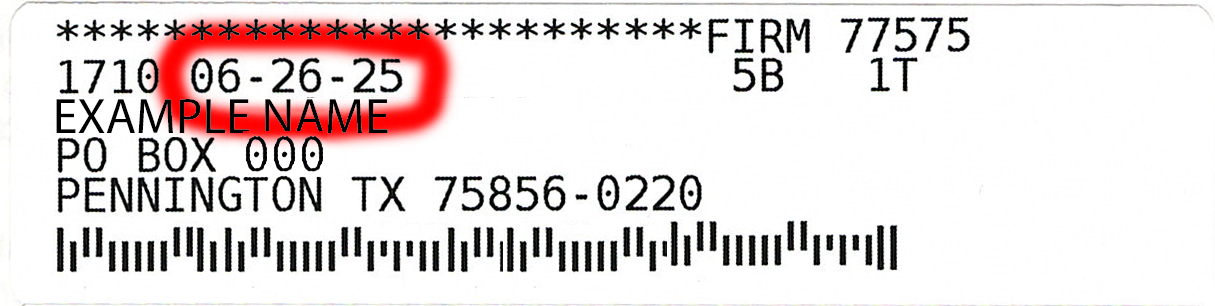

Hello everyone! Please check to make sure your subscription is up to date. If you were previously receiving a copy of the newspaper by mail, you will receive the issue going out on July 8th. After that time, if you have not renewed your subscription, we will cease sending you a newspaper. This means you will not recieve a paper NEXT WEEK, if you have not resubscribed if your expiration date has passed. There is a very easy way to determine if your subscription is up to date.

Look at the mailing label on the front of your paper(Example Above). The first line underneath the line of stars has a number (your Centerville News ID number) followed by a date(circled in red). That date is when your subscription ends or ended. If you find that your subscription is out of date, do not fret!

There are two ways to renew:

Subscription page of our website (“My Subscription Is Expired” Button below)

OR mail your payment and information to P.O. Box 97, Centerville, TX 75833.

7 Day weather outlook Provided By KBTX

(7/9/25—7/15/25)

Contact Centerville News

Please enter your message and info here and we will get back to you soon!

Contact@CentervilleNews.net

(936) 966-1292

P.O. Box 97

Centerville, Tx 75833